Beef kill: Scarcity of finished cattle as supplies drop further

The beef kill in week 29 at Department of Agriculture, Food and the Marine (DAFM)-approved factories stood at just under 23,800 head (excluding veal), latest figures show.

The week ending Sunday, July 20, saw factory supplies fall further below the previous week and over 8,500 head below the same week of last year.

A projection from Bord Bia in January 2025 forecast 87,000 fewer cattle to be available for slaughter this year, with a drop of 5% in the prime cattle supply.

But in May, Bord Bia revised this figure upwards to a 7-8% drop in the prime cattle kill.

Supplies had been strong all year and kill numbers were running ahead of last year for the first half of the year, a trend which is now expected to further compound the scarcity of finished cattle in the coming weeks.

This supply shortage of beef is also being seen across Europe and in countries further afield, and the trend is not expected to subside any time soon.

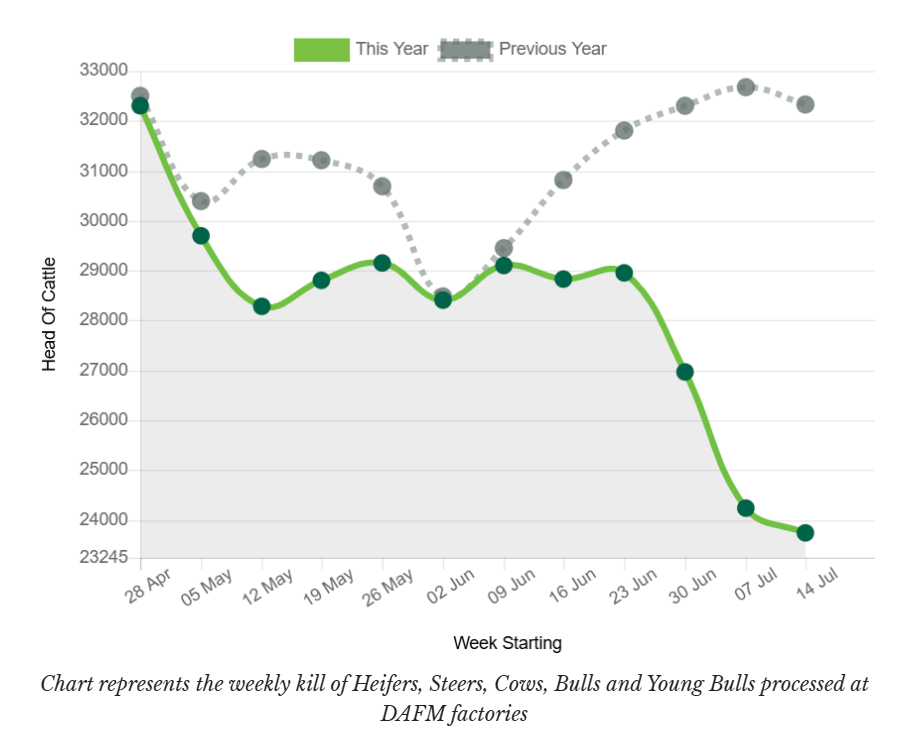

The graph below shows how weekly beef kill numbers this year have been comparing to last year:

As can be seen from the above graph, weekly kill numbers in 2024 incrementally rose from June onwards, as opposed to this year where supplies remained steady and fell significantly since late June.

The table below details cattle supplies in the week ending Sunday, July 20, compared to the same week of last year, and the cumulative kill-to-date this year compared to last year:

| Category | Week ending July 20, 2025 | Equivalent Last Year | Cumulative 2025 | Cumulative 2024 |

|---|---|---|---|---|

| Young Bulls | 1,559 | 1,636 | 68,628 | 71,627 |

| Bulls | 456 | 772 | 14,189 | 16,183 |

| Steers | 8,842 | 12,642 | 344,770 | 341,620 |

| Cows | 5,972 | 8,557 | 215,076 | 243,930 |

| Heifers | 6,916 | 8,724 | 299,986 | 278,988 |

| Total | 23,745 | 32,331 | 942,649 | 952,348 |

The tight supplies are seeing an uplift in the prices paid to farmers, and further trade positivity is expected for the short-term at least.