Report: New EU carbon tax on fertiliser will have 'significant price impact'

European fertiliser prices are likely to rise with the introduction of the EU’s Carbon Border Adjustment Mechanism (CBAM) according to a new report.

The CBAM 'definite period" is scheduled to start from January 1, 2026 and this, according to the new RaboResearch report, will impose a carbon tax on approximately 15 million metric tons of nitrogen-containing fertiliser imports annually.

According to the EU CBAM is a "tool to put a fair price on carbon emitted during the production of carbon-intensive goods that are entering the EU".

Researchers have warned that "the CBAM will have a significant price impact on high-emission nitrogen fertilisers, particularly ammonia and urea, which dominate EU import volumes and carry the highest embedded emissions".

Ammonia, necessary for fertiliser production, is expected to see price increases of between 10% to 20% in 2026, which could potentially rise to 50% by 2027.

Urea, the most traded nitrogen fertiliser globally, is likely to face a 10% to 15% price hike next year but this could escalate to 45% by 2030 according to the RaboResearch report.

Fertiliser

Researchers believe that global fertiliser markets are now "entering a new phase of contraction, as rising prices begin to weigh on demand".

Urea consumption is forecase to fall next year while phosphate demand has already dropped by 4% this year with further declines expected in 2025.

Potash demand which bounced in 2024 due to lower prices is likely to slow again in 2025 according to the RaboResearch report.

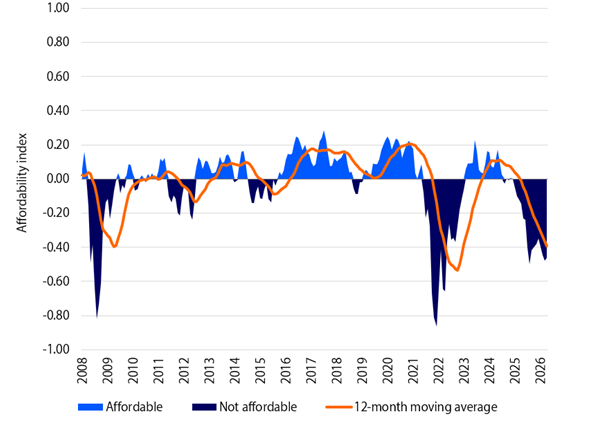

Although commodity prices have remained stable since the start of this year there has been a decline in "fertiliser affordability" according to researchers, which is mainly due to an increase in global fertiliser prices.

The RaboResearch report outlines that European fertiliser prices rose significantly this year driven by global market dynamics.

"Compared to 2024 prices increased by 20% for nitrates, 15% for phosphates and 5% for potash.

"In 2026 a moderate price decline is expected for phosphates and potash, while urea is projected to move on structurally higher levels for European users," the report also detailed.

One key forecast that the RaboReseach report also highlights is that agricultural commodity prices - both domestic and global - are projected to "remain low" in 2026, which will impact on farmer purchasing patterns.