Report: Fertiliser prices are 'trending upwards'

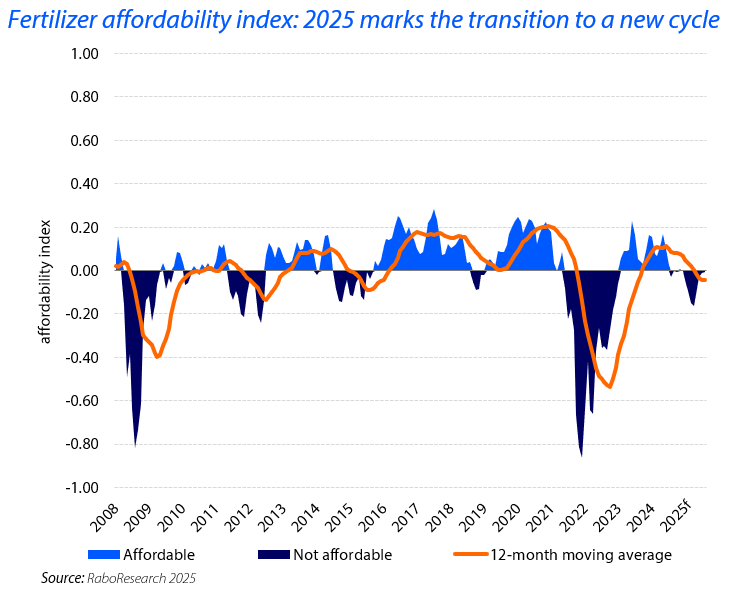

Fertiliser prices are showing an "upward trend for 2025" which will squeeze farmers' buying power, according to a new report.

The Rabobank report warns that the global fertiliser market is expected to face "another challenging year in 2025" - particularly for nitrogen and phosphate-based fertilisers.

The report also details that over the past 18 months the global urea market has been "highly reactive" to the Indian market's movement in purchasing fertilisers.

"Each new tender issued by the Indian government led to price increases in the nitrogen fertiliser market, indicating a possible tightening in the balance between supply and demand," the RaboResearch team highlighted.

Meanwhile the outlook for the potash market this year, according to the report, remains "quite positive in terms of buying power and demand".

"Potash a nutrient produced in only a few specific regions, is highly susceptible to geopolitical issues.

"Despite current geopolitical turbulence the potash market is rather stable, supported by the ample supply of the product," the RaboResearch team stated.

However one key trend that is likely impact the fertiliser market in general this year according to researchers is the "tariffs threat".

"Tariffs disrupt and damage long standing trade relationships," the report outlined.

Fertiliser

According to the RaboResearch team European demand for fertilisers has been robust.

"Favourable weather at the start of the 2024/25 crop season motivated farmers to apply optimal fertiliser levels of winter crops.

"Warm dry conditions also supported early sowing of spring crops and fertiliser application," the team detailed in the report.

Specifically the 2025 outlook for European fertiliser prices indicates that nitrogen prices will return to last year's levels.

"This is due to ample availability and decreasing input costs like natural gas and ammonia.

"Phosphate prices decreased marginally but are expected to remain elevated due to tight supply. Potash recorded small gains but is set to remain affordable in the long term due to ample supply," the report outlined.

However according to the RaboResearch team "more impactful changes are expected for the longer term".

One of the reasons for this is because of the European Commission's proposed tariffs on fertilisers to reduce dependencies on imports from Russia and Belarus.

"These tariffs are set to escalate from 6.5% to 100% over a three year transitional period.

"The proposal has been approved by the European Council and awaits voting by the European Parliament in May 2025," the Rabobank report outlined.