CSO: New tractor registrations drop by more than 11%

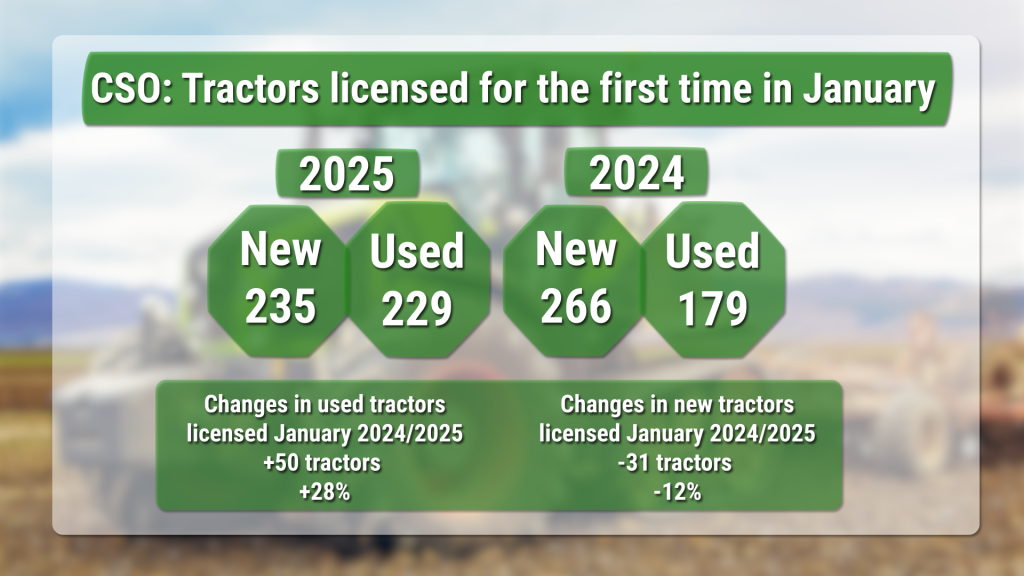

The latest figures for tractor registrations for January 2025 show a decline of 11.7% from January of 2024 and are 7.3% down from the average of the last 10 years according to the Central Statistics Office (CSO).

The reality of January 2025 might come as a slight disappointment in the trade as the gloom of last year had lifted in the autumn and dealers were considerably more optimistic about 2025 than they were about 2024.

Yet the figures indicate that new tractors sales are not as buoyant as had perhaps been anticipated.

However, used tractor registrations showed a marked increase of 28% and the optimism in the trade may have reflected the interest in second-hand equipment rather than new.

Looking ahead

The new registration figures for January do not bode well for the coming year.

On average, 12% of annual tractor sales occur in the first month of the year which suggests that potentially, just short of 2,000 new tractors will be registered this year.

| Year | Total registered in Jan | Annual total | % of annual total sold in Jan |

|---|---|---|---|

| 2025 | 235 | ||

| 2024 | 266 | 2131 | 12.4 |

| 2023 | 296 | 2310 | 12.8 |

| 2022 | 252 | 2368 | 10.6 |

| 2021 | 258 | 2491 | 10.4 |

| 2020 | 247 | 2190 | 11.3 |

| 2019 | 292 | 2137 | 13.7 |

| 2018 | 239 | 2043 | 11.7 |

| 2017 | 194 | 1810 | 10.8 |

| 2016 | 257 | 1934 | 13.3 |

However, January sales are not necessarily that reliable an indicator; they suggest a trend for the year rather than foresee a definite total, so 2025 cannot be totally written off just yet as there is obviously a hunger for fleet renewal as can be seen from the used sales.

One ray of hope for the dealers and manufacturers is that as the supply of good used tractors dries up, farmers will have to consider new machines after all, and with both beef and dairy enjoying decent returns, that moment may not be so long off, especially if trade-in values rise.

Simple machines to boost registrations

Machinery manufacturers are already responding to the disinclination of farmers to buy expensive new machinery by producing less sophisticated versions of their present ranges, stripping cost out of the equipment rather than dropping the price of standard models.

Claas is the latest to respond in this way with its latest Series 3 range being unashamedly targeted at those with a more modest budget, or without the need for chips with everything.

An approximate rule of thumb is that tractors cost around €1,000 per horsepower, yet the top of the range 120hp Claas 3.120 retails at €642/hp, a significant variation from the average and Claas already reports healthy sales of these new units.

Massey Ferguson has also announced that its latest range of small tractors are to be built by SDF which has a sizeable production facility in Turkey.

No model details or prices have been announced but energy costs for Turkish business stood at half that for Germany in June of last year, and this will no doubt be reflected in the eventual retail price should it be this factory that produces the range.