6.3% revenue growth for Kerry Group in first 3 months of 2025

Kerry Group has announced a 6.3% boost in revenue over the first three months of this year.

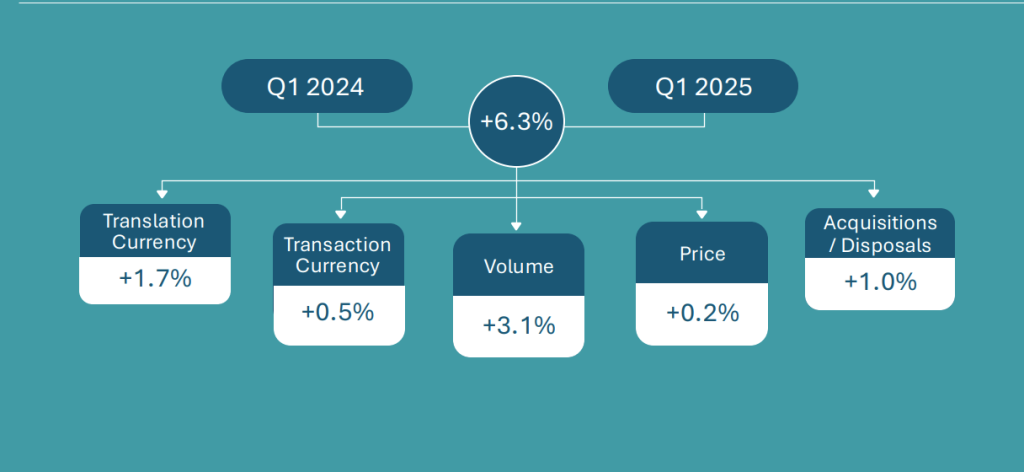

In its Q1 Interim Management Statement 2025, reported revenue increased by 6.3% in the period, comprising volume growth of 3.1%, positive pricing of 0.2%, favourable transaction currency of 0.5%, favourable translation currency of 1.7%, and contribution from acquisitions net of disposals of 0.8%.

Continuing business EBITDA (earnings before interest, taxes, depreciation, and amortisation) margin increased by 90bps (basis points), primarily driven by cost efficiencies, contribution from acquisitions, operating leverage, and portfolio mix.

According to Kerry Group, end market conditions in the period reflected generally cautious consumer behaviour, given the level of macroeconomic uncertainty across different geographies.

Customer product innovation centred around new and differentiated flavour combinations and healthier options, while product renovation activity focused on enhancing product nutritional characteristics and solutions to address challenges in global raw material supply chains, the statement revealed.

Kerry Group food service

According to the Kerry report, growth was led by performance in foodservice and emerging markets

- Volume growth of 3.1%;

- Growth led by Beverage, Bakery, and Snacks;

- Pricing of 0.2% reflected input cost inflation in places.

The business delivered good volume growth in the period given overall consumer market demand, according to the company.

Foodservice continued its outperformance with volume growth of 4.7%, driven by new menu innovations, seasonal products, and solutions to reduce operational cost and complexity, the statement outlined.

Growth in the retail channel was supported by an increase in nutritional enhancement renovation activity with a range of customers.

Growth in the period was led by 'Beverage, Bakery, and Snacks' end markets, supported by strong growth in savoury taste and Tastesense salt and sugar reduction technologies, as well as integrated solutions incorporating Kerry’s botanicals, natural extracts, and enzymes, according to Kerry.

Business volumes in emerging markets increased by 6.4% in the period, led by a strong performance in Southeast Asia.

Within the 'Pharma & Other EUM', volume growth was driven by cell nutrition and excipients.

Kerry Group chief executive, Edmond Scanlon said: "We delivered a good overall performance in the first quarter, particularly given market conditions.

"We achieved good volume growth in the Americas and APMEA [Asia Pacific, Middle East, and Africa], with Europe similar to the prior year. Our strong EBITDA margin expansion was led by efficiencies delivered through Accelerate operational excellence.

"Against a backdrop of highly dynamic macroeconomic conditions, our extensive local footprint, our unique offering, and the strength of our business model positions us well to navigate through this period, supporting our customers as their innovation and renovation partner.

"While recognising the heightened level of market uncertainty, we remain well positioned for good volume growth and strong margin expansion, and we maintain our full-year constant currency earnings guidance," Scanlon said.

Regional review

Within North America, 'Bakery' achieved strong growth driven by integrated solutions incorporating Kerry’s taste and texture systems as well as enzymes.

'Snacks' delivered strong growth through innovations utilising Kerry’s range of savoury taste profiles and Tastesense salt reduction technologies, given continued customer focus on improving the nutritional profiles of their products.

Growth in 'Dairy' was driven by the strong performance of taste technologies, while performance within the 'Meat' end market reflected softer overall category volumes.

Within the retail channel, growth was supported by renovation activity across customer and retailer brands, while growth in the foodservice channel was led by quick service and fast casual restaurants.

Within Latin America, strong growth was achieved in Brazil and Central America across the 'Snacks' and 'Meals' end markets in particular.

In Europe, good growth was achieved in 'Beverage' supported by new beverage innovations incorporating Kerry’s integrated taste technologies and proactive health ingredients, with increased customer innovation activity for Kerry’s all-natural citrus flavour extender technology across beverage applications against a backdrop of global supply chain challenges.

Growth in 'Bakery' was led by performance in texture systems, with softer dynamics within the 'Meals' and 'Dairy' markets, according to the Kerry Group report.

Growth in foodservice was led by quick service restaurants and coffee chains, while softer retail channel volumes reflected subdued demand.

Performance in the APMEA region was primarily driven by strong growth in Southeast Asia, the Middle East and Africa, with volumes in China remaining challenged.

Financial review

At the end of March, net debt was €1.9 billion reflecting cash generation, capital investment and the share buyback programme.

Kerry’s consolidated balance sheet remains strong, according to the company, which it said will facilitate the continued strategic development and growth of the business.

As of the end of March, Kerry had repurchased €185 million of ordinary shares from the €300 million programme that was initiated in November 2024.

Aligned to its Capital Allocation Framework, Kerry said it intends to initiate a further share buyback programme of up to €300 million of Kerry Group plc ordinary shares after the completion of the existing programme.

A formal announcement is expected to be made prior to its launch. As previously announced, Kerry has proposed a final dividend of 89c/share for approval at the Annual General Meeting (AGM).

Outlook

Against the backdrop of highly dynamic macroeconomic conditions and the continually evolving tariff and global trade landscape, Kerry has said that its extensive local footprint, global sourcing network, and customer-centric business model positions it well to navigate through this period.

While recognising a heightened level of market uncertainty, Kerry believes it remains well positioned for good volume growth and strong margin expansion.

Kerry maintains its full year constant currency earnings per share guidance growth of 7% to 11%.