51% rise in horticulture input prices over past 5 years

The cost of inputs for the horticulture sector has increased by an average of 51% over the past five years, according to a new report.

The Horticulture Crop Input Prices 2025 report, published by Teagasc, stated that the input cost increases range from 36-76% depending on horticultural sub-sector since the first report was published in 2021.

In 2025, labour which accounts for on average 42.6% of the input costs in horticulture, has contributed to overall input price inflation in the sector.

An additional increase in the national minimum wage at the start of this year has resulted in a further increase in the cost of labour.

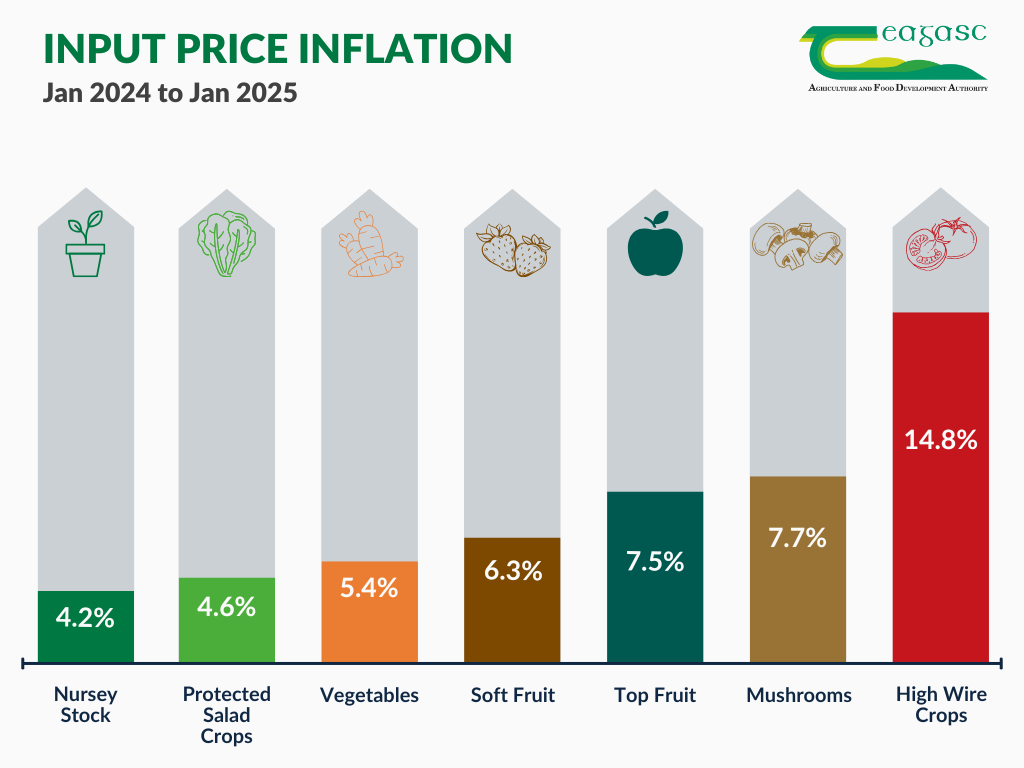

A snapshot of input prices in January 2025 compared to the same month in the previous year shows input price inflation across most of the key inputs.

High wire crops saw the most significant increase in costs at 15%, followed by mushrooms (8%) and top fruit (7.5%)

Horticulture is the fourth largest agricultural sector in Ireland after dairy, beef and pigs in terms of gross agricultural commodity output value, with a farm gate value of €521 million.

The horticulture sector is diverse and covers plant and food horticulture. Horticulture food includes mushrooms, potatoes, field vegetables, soft fruit, protected crops and outdoor fruit.

The challenges faced by the sector are varied, however, over the last two years, the combined impacts of climate change, energy cost fluctuations, and the cost and availability of labour are increasingly driving an increase in the cost of production.

The recent impacts of Storm Éowyn in January also highlighted the damaging effect that weather events can have on the sector.

While the storm proved to be unprecedented, it followed on from a very difficult 2024 growing season.

"Investment from the sector to reduce the reliance on labour and the impacts of climate events will require a market response to ensure the economic and environmental sustainability of Irish horticultural production into the future," the report said.

The report added that technologies to reduce the reliance on labour are beginning to be trialled in some key horticultural sub-sectors.

However, the financial cost of these technologies is significant and availability likely to be limited in the short to medium term.

Horticulture

The mushroom industry is the largest horticultural sector in Ireland with a farm gate value of €158.6 million, of which approximately 85% is exported to the UK.

The industry employs 2,968 people with labour representing 44% of total input costs.

An increase in the national minimum wage, employers PRSI, statutory sick leave entitlements and the introduction of pension auto-enrolment this September have resulted in labour costs for mushroom growers increasing by 8%.

A significant portion of operatives and harvesters working on mushroom farms are from non-EU countries, employed under general employment permits.

One major issue facing growers is the requirement to raise the salaries of these workers from the current minimum wage to €30,000 when renewing their permits.

"This development is particularly alarming for mushroom growers, many of whom operate on slim profit margins," the report said.

The planned increase to minimum annual remuneration (MAR) thresholds is currently being reviewed by the Department of Enterprise, Trade and Employment (DETE).

The report also highlights that mushroom substrate price has increased by 9% in the reference period. Mushroom substrate represents 34% of total input costs.

The soft fruit industry in Ireland is currently valued at approximately €50 million.

The largest of the soft fruit crops grown is strawberries, representing 90% of the total.

Teagasc estimated input price inflation for this sector to be 6.3%. However, for growers using natural gas, it estimated the cost price inflation to be 13.7%.

Labour accounts for 44% of total input costs on these farms, with costs rising by 6.6% in this sector in 2024.

Costs

Ireland’s protected vegetable sector includes a range of edible crops grown in greenhouse structures where controlled environments are required for production purposes.

The report noted that input costs vary significantly between crops.

Input price inflation in high-wire crops, such as tomatoes, cucumbers and peppers, is reported as 14.8% since January 2024.

The inflation is primarily linked to increases to the cost of labour and natural gas, which the sector is dependent on for heat and carbon dioxide supplementation.

Energy now accounts for 25.7% of the cost of production in the high-wire sector. The cost of natural gas has increased by 59.8% in the period January 2024 – January 2025.

Input price inflation in the protected salad crops is estimated to be 4.6%.

Input price inflation in the field vegetable sector has continued at a rate of 5.4% in the year up to January 2025, and input costs have inflated 50.6% since March 2021.

Wet weather and soil conditions from August 2023 until April 2024 seriously affected the quality and marketable yield of overwintered crops such as carrots, cauliflower and cabbage.

The challenging conditions also significantly delayed the establishment of new season crops.

Labour is the most significant input in field vegetable production and now makes up on average 39.6% of the overall cost of production.

Michael Gaffney, acting head of the Teagasc Horticulture Development Department, said that the report "indicates significant input price inflation since 2021 in the horticultural sector".

"Primary producers are facing significant challenges from multiple sources.

"The impact of climate events, from the loss of many early plantings due to rainfall in 2024, to the recent storm damage suffered by the sector, highlights the need for primary producers to receive a margin on their crops above costs to allow for investment in their businesses.

"The ability to reinvest, combined with longer term sourcing agreements can also contribute to encouraging generational renewal of businesses," he said.