4% decrease in prime beef production forecast for 2026 - Teagasc

There could be a 4% decrease in prime beef production in Ireland next year according to Teagasc economists.

In the Teagasc Outlook 2026 report they explained that the outlook for prime beef supplies is determined by the current inventories of animals aged 12 to 24 months of age.

These inventories are currently "significantly lower" compared to levels observed 12 months earlier.

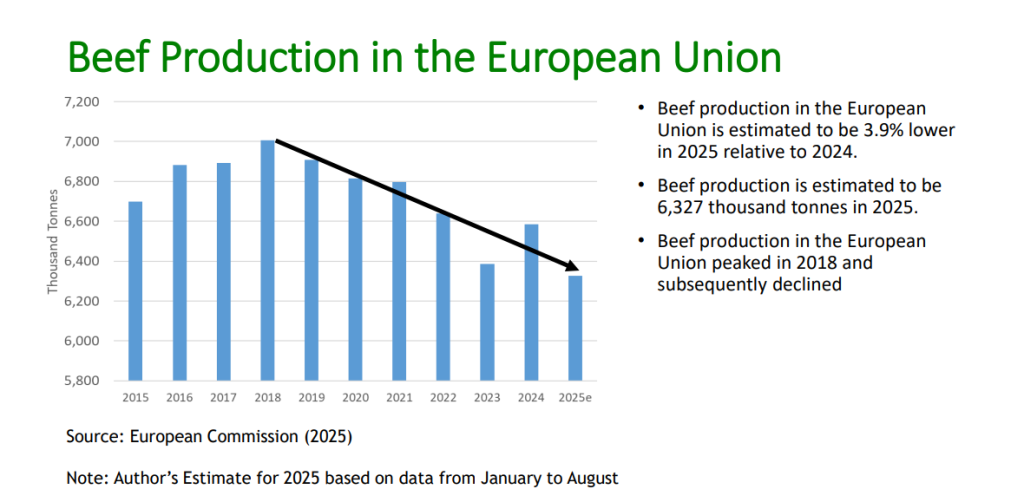

According to Teagasc economists EU production of beef next year is forecast to be similar to this year.

Latest analysis also suggests that the number of cattle in key EU export destinations was "significantly lower in June 2025 relative to June 2024".

"This points to a continued decline in beef supply in markets, which are of most relevance to the beef sector in Ireland," they added.

Beef

According to the Teagasc economists beef cow numbers declined in 2024 in many EU member states including Ireland, France and Spain.

Meanwhile in the UK they outlined that there have also been "notable declines in the size of the breeding herd" and particularly for non-dairy cows.

"This points to some further contraction in UK beef production in the medium-term - beyond 2025," economists added.

But they have also warned that while consumer prices for beef in the UK increased strongly this year there is a "preference among UK consumers for beef sourced in Britain".

How does the outlook for beef production in the UK and EU impact on Irish farmers?

According to Teagasc economists there is likely to be a 5 % increase in the annual average finished cattle price in 2026 compared to to the annual average in 2025.

"This equates to a price of approximately €795/100kg - including VAT - for the average R3 steer," they added.

However when it comes to prices for weanling cattle, they are less optimistic and expect these will fall by 5% next year compared to the 2025 levels.

"Gross output for the average single suckling enterprise is therefore forecast to be slightly lower relative to the estimated 2025 levels," economists have warned.

Meanwhile they have also detailed that in 2026, the final net margin on cattle farm enterprises will be dictated by three key factors: "cattle sales, cattle purchases and input expenditures".

"On a per hectare basis, the direct costs are forecast to increase by 2% on the average singles suckling enterprise and by 1% on the average cattle finishing enterprise," economists said.

Net margins

In terms of the end results for beef farmers Teagasc economists have forecast that the average cattle finishing farm will have a higher net margin in 2026 compared to 2025 with a forecast of €616 per hectare.

But net margins for the single suckling enterprise are forecast to decline in 2026 compared to 2025 however they will remain "well above previous levels".

In relation to the average single suckling enterprise economists believe they will see "a positive net margin per hectare of €767" next year.