EU exports of live cattle continue to do very well thanks to sustained demand in the Mediterranean region, according to latest figures from the European Commission.

During the first quarter of 2016, live exports increased by 30% compared to already high 2015 levels. Live trade is still focussed on countries around the Mediterranean.

The Commission says Turkey (100,000 head) and Lebanon (45,000 head) remained the two most important destinations of live bovine animals in the first four months of 2016 and represented together almost 50% of total live trade.

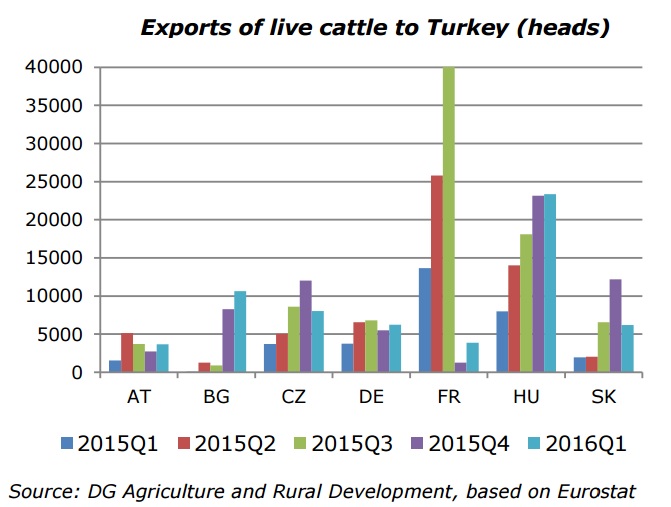

The biggest EU supplier to Turkey was Hungary, which exported already more than 33 000 heads over the same period. Israel took over Libya’s position as EUs’ third most important destination.

Ireland was recently listed by the Turkish Ministry for Agriculture as a country from which live bovines may be imported.

“This follows pro active and detailed engagement by his department with its Turkish counterparts and an inspection by a Turkish veterinary delegation in May.”

It is understood the immediate requirement in Turkey would be for live exports in the form of younger stock, mainly bull weanlings up to 12 months of age and up to 300kg, from the suckler herd.

The cattle will be bought in Ireland at 250kg to allow for six weeks of lairage and shipping time, it is believed.

Negotiations are continuing on Irish cattle live exports to Turkey. Sources say that the Turkish government is in the process of awarding contracts for the importation of Irish cattle, but Irish exports must wait until this happens before any movement of cattle can take place.

Ireland will have immediate access to the market, when a deal is finalised, but Canada also recently secured similar access for live exports to Turkey.

Bluetongue

The 2015 outbreak of bluetongue in France continues to impede France’s ability to benefit from these market opportunities.

Thirteen new cases were reported during the period of half May to half June 2016, bringing the total to 285. A negative impact on French live exports was observed since the last quarter of 2015 (see graph 18). Live exports to Turkey are also

South Americans also eyeing Turkish Market

Live exports to Turkey are also facing increased competition from Uruguay and Brazil, according to the Commission. It says beef prices in Turkey are still relatively high, because the development of Turkish production capacity is taking longer than expected and demand is strong.

Therefore, EU live bovine exports are expected to further increase by 12% in 2016 and to stabilise at this high level in 2017, reaching almost 200,000 tonnes c.w.e. (above 2013- 2014 levels).

Turkish beef imports

According to the Commission, to date (April), beef meat exports increased by 10%. Turkey accorded last year a TRQ to the EU for the imports of meat but an extension of the TRQ in 2016 (by 20,000t) is still under negotiation between the Turkish authorities and the European Commission.