Update: 2nd March 2017 – Bank of Ireland can only accept loans on a provisional basis as it has exhausted its allocation of the funds.

Last week Bank of Ireland opened its application process for the new Agriculture Cashflow Support Loan Scheme.

The new scheme is subsidised and guaranteed by the Strategic Banking Corporation of Ireland (SBCI) in partnership with the Department of Agriculture, Food and the Marine and the European Investment Fund.

John Fitzgerald, Head of Agriculture, Bank of Ireland has given an assessment of how the scheme is going and gives some advice on how farmers can make the application process as easy and quick as possible.

“With an allocation of €65m, Bank of Ireland has the largest individual share of funds available. In the first week we are seeing very strong interest and demand for the scheme, with a wide variation in loan purposes.

“The main purposes include funding of trade credit, annual stocking loans and refinance of farm development projects which have been funded by cashflow in recent years.

“However a number of farmer customers have applied for ineligible loan purposes under the SBCI loan scheme.

Typically these include land purchase, future farmyard development, breeding stock, machinery finance and repayment of existing farm loans.

“While these are amongst the loan purposes that are ineligible under the SBCI scheme, there are other funding options available to farmers from Bank of Ireland.”

In order to expedite the loan draw-down process, the bank is encouraging farmers to ensure they are fully aware of the eligible loan purposes under the scheme:

- To fund future working capital requirements (e.g. feed, fertiliser, trading stock, other costs etc.).

- As an alternative to merchant/trade credit (e.g. refinance of existing balances with a Co-op/Agri merchant or the finance of future working capital used to fund feed, fertiliser, seed etc. required over the coming 12 months).

- To replenish cash flow already used (prior to December 31, 2016) to fund farm capital investment (e.g. land and machinery purchase as well as land drainage and farmyard development costs).

John Fitzgerald highlights that farmers should consider the appropriate loan terms aligned with the purpose of the loan being sought and the bank has issued the following guide as a reference point:

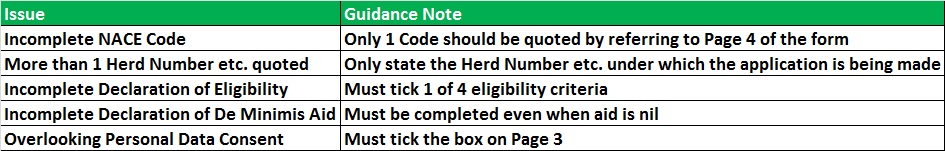

“Some applicants have made errors when completing the SBCI application form so unfortunately a number of forms have had to be returned for a wide variety of reasons.

“We would encourage people to consider the following when they are filling out the forms so the process is simple and transparent.”

Farmers can find out further information on the Bank of Ireland –SBCI Agriculture Cashflow Support Loan scheme online.

To apply, call Bank of Ireland at 1890 365 222 (Monday to Friday 8am to 8pm and Saturday from 10am to 2pm) or arrange a meeting with your local Bank of Ireland Business Adviser/ Business Manager.