In these uncertain times, it’s more important than ever for farmers to ensure they’re getting the best value for money on farm inputs, starting with farm insurance.

This article will provide you with important tools to find the best farm cover for your needs.

1. Preparation

Request to see your policy schedules from your insurance provider. This will help you when researching your policy, and in discussing the best cover options with insurance providers.

When you review your insurance schedule, ask yourself what cover you now need to consider as a result of changes to your farming business such as:

- Changes to farm ownership / partnerships / limited company structure, etc?

- Farm labour – any amendments to employees; paying more or less wages; permanent/casual/voluntary?

- Do I have an alternative type of enterprise or secondary enterprise? All business activity on the farm must be declared to ensure policy cover in the event of a claim;

- Any newly built farm buildings and contents / removed or modified buildings?

- Do I have higher or lower livestock levels?

- What changes have I made to my list of farm equipment? Are my values for milking equipment and bulk tank sufficient? Do I require cover on computerised components of the miking equipment? Are the details of my trailers, fertiliser spreader, slurry tanker, diet feeder and mower up to date and accurate? Give special consideration to items prone to damage and/or theft;

- Are there any changes to acreage farmed?

- Are there any changes to machinery, tractors, loaders, quad, gator, harvester?

- Am I protected against farm theft? Are my storage buildings secure and what could be stolen?

By asking yourself these questions as you review your cover, you will put yourself in a better position to choose the right cover for you.

2. Farm jeeps

Over 60% of farmers use jeeps, and the premium charged for farm jeeps has often been the ‘game changer’ and deciding factor in switching to another provider.

AXA has made this easy for you by insuring farm jeeps as part of the farm package. It’s included with your farm and machinery to give you a great value farm insurance package.

3. Additional farming enterprises – incorporated into farm insurance

Many farmers have secondary occupations as means for more income. It is important to check if your insurer facilitates liability cover for any of the following secondary occupations:

- Guesthouses;

- Food manufacturing;

- Farmers attending markets;

- Cattle bed and breakfast;

- Milk recordings;

- A.I. technician;

- Knowledge transfer events;

- Discussion groups;

- Agricultural contracting;

- Artisan foods;

- Soft fruit / vegetable growers;

- Artificial insemination agent / animal scanning;

- Dog grooming / pet holiday kennels;

- Milk recording agents.

4. Easy to switch

When shopping around for insurance, select an insurer that makes it easy for you to switch.

AXA has made it easy for farmers to change with a process that’s hassle-free:

- No requirement to call out to your farm;

- Switching can be done over the phone, or by calling into an AXA branch or a broker office;

- No requirement for form filling;

- Simple assessment of outbuildings suitability for storm cover (using Google Earth and other tools for suitability of storm covers).

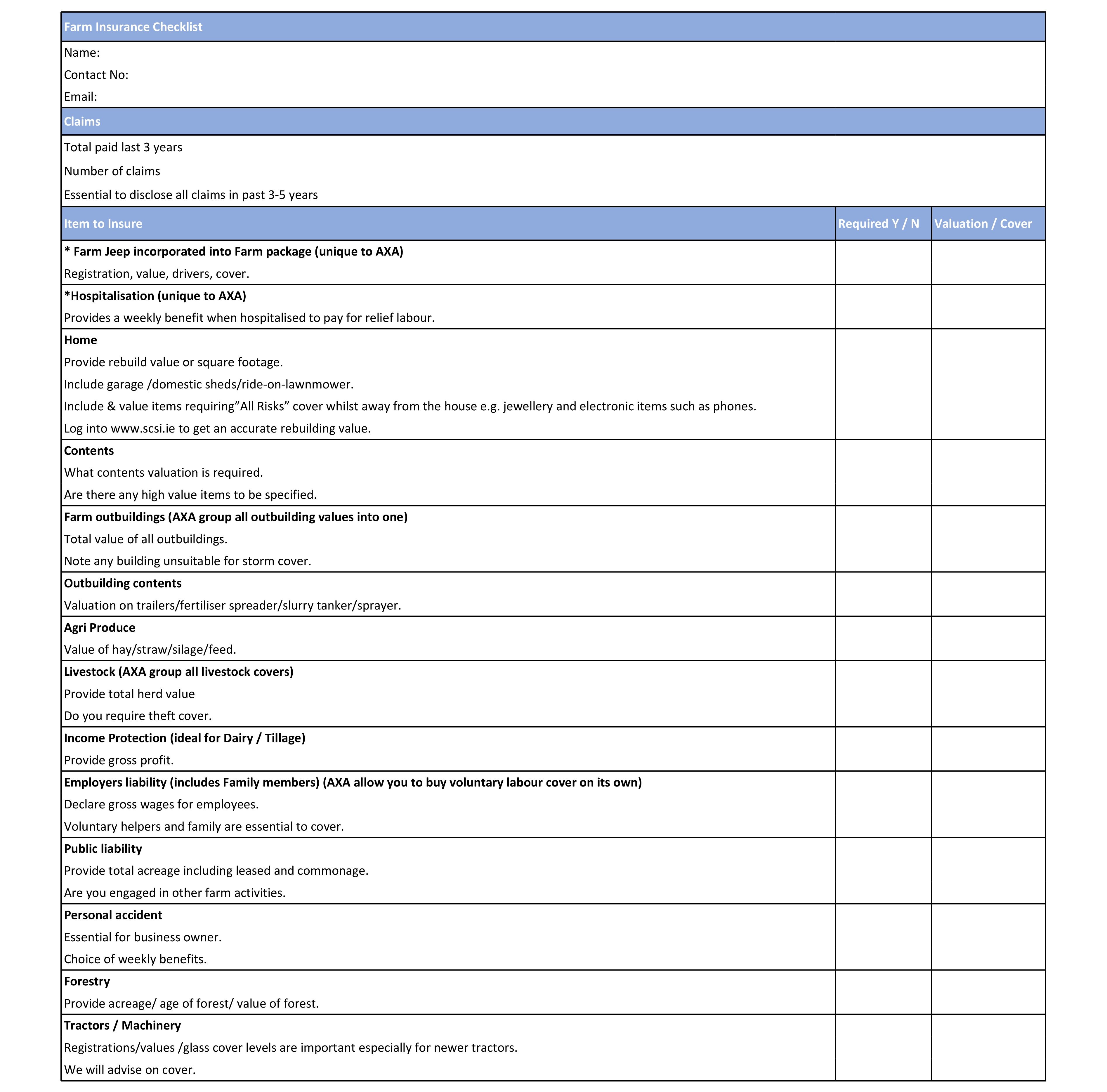

5. Farm insurance checklist

Use the following checklist to prepare for the discussion with your insurer by web, telephone, branch or broker. It will help you get best cover and best value for money.

Further information

For further information on the above, or on AXA Smart Farm Insurance, visit: axa.ie/farm.

Alternatively, if you’d like to speak to an agri-specialist, contact Brian Prout on: 087-938-7004.

AXA Insurance dac is regulated by the Central Bank of Ireland.