Wheat and corn moved down this week. Corn crops are in good condition in the US, Ukraine and France according to reports and at present there looks to be plenty of supply for the market.

The Agriculture and Horticulture Development Board (AHDB) reported this week that the Ukraine Grain Trade Association increased its domestic maize crop estimate to 38.9 million tonnes – 2.1 million tonnes above previous forecasts. Exports are expected to break records in 2020/2021.

Strategie Grains revised maize crop conditions in France. It placed 77% of the crop in good or excellent condition – down from 80% last week. The production forecast is currently at 14.9 million tonnes – 2.6 million tonnes greater than the 2019/2020 season.

The drop in corn prices will not be welcomed by Irish farmers who associate high maize supply and low maize prices with low grain prices here.

UK yields and usage

The AHDB has reported that winter oilseed rape and winter barley yields are “down sharply”.

Yields of winter oilseed rape are reported to be averaging between 2.5t/ha and 2.9t/ha. This is 15-20% below the five-year average of 3.5t/ha.

The high area of spring barley planted this year means there will be plenty of barley to export and prices reflect that as feed barley currently sits approximately £40/t below feed wheat.

1.77 million tonnes of barley were used by the sector in the 2019/2020 season – down 6.4% on the 2018/2019 season.

As usage remains slower than normal, as a result of the Covid-19 pandemic, UK barley prices are not getting any support.

A good outlook for maize crops and supplies is not expected to help prices in the coming months.

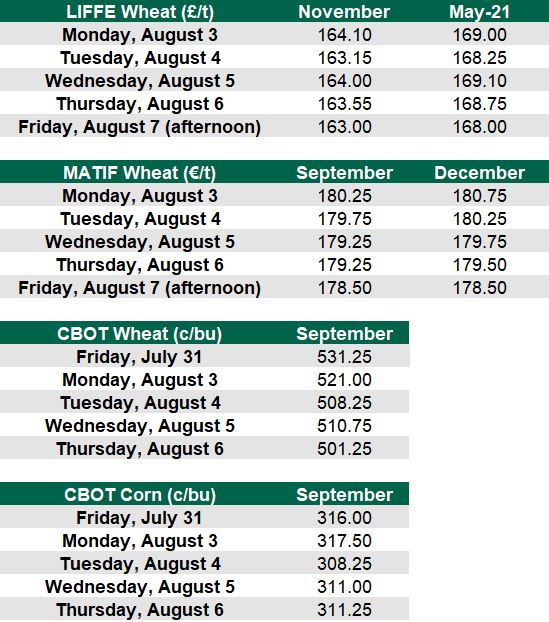

Grain markets

At home this week, Glanbia offered €155/t for green wheat and €137/t for green barley before any bonuses were added on.

On the continent feed barley (delivered Rouen) was trading at €163/t on Friday morning, August 7, while Free-On-Board (FOB) Creil malting barley was trading at €173/t.

The current Boortmalt average price which is to be paid to suppliers this harvest was at €173/t last week.