Official figures from the Department of Agriculture’s beef kill database show that some 35,572 cattle were processed during the week ending July 15 – an increase of 1,377 head or 4% on the week earlier.

In addition, some 13,510 steers were processed – an increase of 1,829 head. Beef cattle prices continue to be under pressure and factory agents are now offering 385-390c/kg for steers and 395-400c/kg for factory-fit heifers; both of these prices exclude Quality Assurance Scheme bonuses.

In recent weeks, some farmers – particularly regular sellers or those with large numbers to market – have been able to secure an additional 5c/kg on top of the base price.

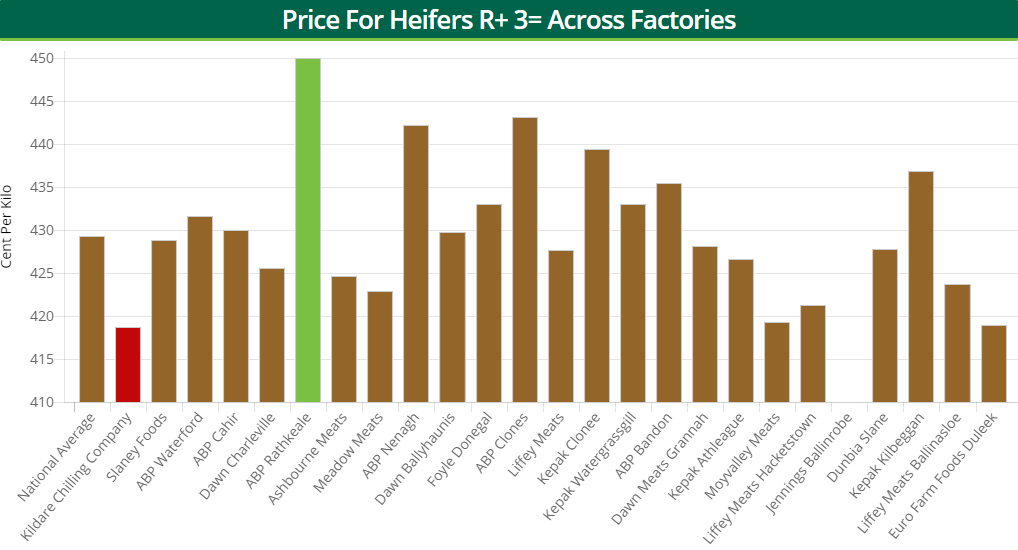

During the week ending July 15, in-spec, R+3= heifers made a top price of 449.95c/kg, while the average price paid stood at 429.29c/kg.

Price cuts could be replicated in the coming weeks and – worryingly for farmers – this comes during a period of strong cattle supplies and no grass growth; both of which are likely to intensify the pressure on farmers to market their cattle in the near future.

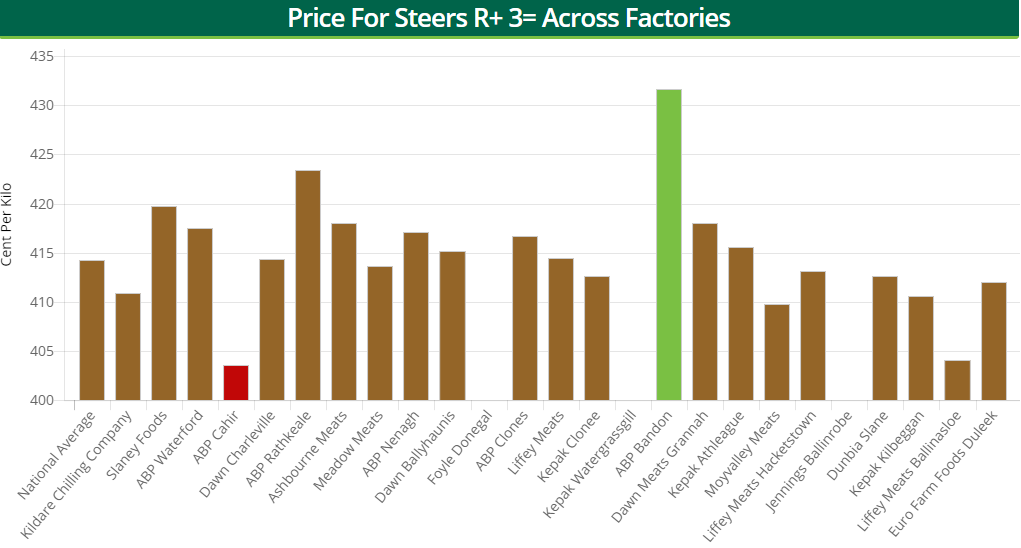

Furthermore, a top price of 431.61c/kg was achieved for R+3= steers; the average price paid for these animals stood at 414.22c/kg.

Cows

Cow prices also remain under pressure and many buyers are starting negotiations for O-grade cows at 300-310c/kg, while negotiations for P-grade cows start at 280-290c/kg. Negotiations for R-grading cows start at 320-330c/kg.

It must be noted that there is a wide variation in the prices for cows being quoted to farmers; this depends on the location and demand of individual processing plants.

Procurement managers – in some areas – have noted the increase in the number of poorer-quality, P-grading cows coming on stream. This is mainly due to drought issues on farms across the country.

During the week ending July 15, O=3= cows made a top price of 340.02c/kg, while the average price paid stood at 326.21c/kg.

For a detailed breakdown of prices, just click here

Cattle throughput

Some 35,572 cattle were processed in Department of Agriculture approved beef export plants during the week ending July 15. When compared to the week previous, the total weekly kill climbed by 1,377 head.

Some 3,659 young bulls were slaughtered in Department of Agriculture approved beef plants during the week ending July 15. This was a decrease of 452 head or 11% on the week before.

Heifer throughput increased with supplies up by 121 head; throughput stood at 8,760 head. Some 9,108 cows were processed – a fall of 174 head. In addition, the number of aged bulls processed increased by 53 head on the previous week’s kill.

The rise in the overall kill can be attributed to the number of steers slaughtered. Supplies of these animals stood at 13,510 during the week ending July 15; throughput grew by 1,829 head.

- Young bulls: 3,659 head (-452 head or -11%);

- Bulls: 535 head (+53 head or +11%);

- Steers: 13,510 head (+1,829 head or +15.6%);

- Cows: 9,108 head (-174 head or -2%);

- Heifers: 8,760 head (+121 head or -2%);

- Total: 35,572 head (+1,377 head or +4%).

‘€180 knocked off a 400kg carcass’

Recent beef price cuts – described as “opportunistic, misguided and short-sighted in the extreme” – have knocked €180 off a 400kg carcass, according to the Irish Cattle and Sheep Farmers’ Association’s (ICSA’s) beef chairman, Edmund Graham.

Last week, the Monaghan farmer argued that – with drought conditions prevailing right around Europe – feed is getting scarce and the price of producing food is rising.

On the back of processors pulling prices for the last number of weeks, Graham said: “The message that should be communicated to retailers is that price rises are required due to the massive increase in input costs.

Prime cattle that were selling up to recently at 430c/kg are making just 385c/kg today. On a 400kg carcass, that’s €180 of a cut – which anybody can see is completely unsustainable.

The industry is also coping with “huge numbers of dairy cows” being presented for slaughter, which is having a “big impact” on the price suckler and beef producers can achieve, Graham maintained.

The ICSA’s beef chairman is of the opinion that the “opportunistic” price cutting by processors “places the entire financial ramifications of this drought on producers”.