The Annual Review and Outlook for Agriculture, Food and the Marine 2020 was published this morning (Thursday, October 8) – which made for mixed news for farmers in terms of income.

Launched by Minister for Agriculture, Food and the Marine Charlie McConalogue this morning, the review and outlook “provides up-to-date information and statistical analysis from a variety of sources, to give a detailed overview of Ireland’s agri-food sector and its outlook for the future”.

Looking specifically at ‘Farm Income and Structure’, this chapter analyses data from the Central Statistics Office (CSO) including the Farm Structure Survey 2016, Teagasc’s National Farm Survey 2019 (NFS) and Eurostat data to show developments in farm income both at Irish and EU level.

The value of goods output at producer prices decreased by 3% to €7.96 billion in 2019. However, on-farm investment was up 3%, or €258 million, to €983 million over this time.

Incomes

Using CSO data, the review noted that aggregate farm income, or operating surplus, in 2019 saw an increase of 4% or €110.7 million on the 2018 figure, despite the decrease in the overall value of goods output.

A return to more typical weather in 2019 resulted in an overall fall in the costs of intermediate consumption. Intermediate consumption decreased by 6% in 2019, to €5,647.7million.

The foremost reason for this change was a decreased consumption of feeding stuffs and fertiliser.

The volume of fertilisers consumed by Irish farmers fell by 8% in 2019, but price increases resulted in the cost of these fertilisers decreasing by just €3.8 million (-1%), from €582.1 million to €578.3 million.

Net subsidies, which remained relatively stable over the past decade, decreased from an average of 90% of operating surplus between 2008 and 2012 to 62% in 2019.

With the operating surplus increasing over the years, and the value of subsidies remaining stable, the percentage contributed by subsidies to the operating surplus is decreasing slightly.

- Average dairy farm income increased by 9% to €66,570 in 2019;

- In 2019 average Cattle Rearing income increased by 11% to €9,188;

- Average income on Cattle Other farms, decreased by 6% to €13,893 on 2018 figures;

- Sheep farms had an average income of €14,604 in 2019 – a 9% increase on 2018 figures;

- Tillage farms had an average income of €34,437, which was a 15% decrease on 2018 figures.

The report said: “Dairy farms are consistently the most profitable farms. However, it should be noted that almost all dairy farms are classified as fulltime farms, with farms requiring 0.75 of a standard labour input being defined as full-time and those requiring less as part time.

“Most cattle farms and the majority of sheep farms are classified as part time in terms of labour input requirements, even though in many cases the farmers may not have off-farm employment.”

Direct payments

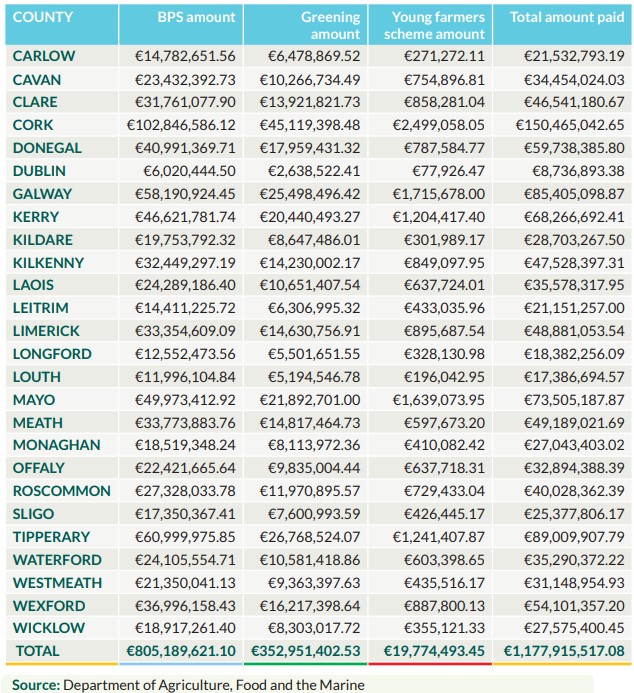

Total direct payments made to farmers for the basic payment scheme, greening and the young farmers schemes were estimated to be over €1.17 billion in 2019, the review notes.

Around 123,000 farmers received BPS payments in 2019, varying significantly in average payments – from between €4,000 and €5,000 in counties Leitrim, Mayo, Sligo, Monaghan, Roscommon, Donegal, Galway and Cavan – to between €9,500 and €10,000 in counties Kildare, Kilkenny, Dublin and Waterford.

Covid-19 impact

In terms of the impact of Covid-19 on Irish agriculture, using Teagasc data it was noted that, in relative terms, beef farming is projected to be the worst affected sector within agriculture, while in absolute terms the reduction in average farm incomes is projected to be largest on dairy farms.

“It is difficult to predict commodity prices, although some signs of stability emerged during the summer,” the review says.

The recovery of commodity prices largely depends on how successful global governments are at controlling the virus and the associated relaxing or strengthening of lockdown measures.

“Were a second wave of the virus to occur, then commodity prices could again come under pressure,” it was added.

Under land mobility and trade, in terms of Covid-19 and the outlook for 2020 as a year, the report said: “Anecdotal evidence suggests that trade in agricultural land was brisk for January and February of 2020.

“However, with restrictions in place and the economic fallout from the current pandemic yet to be fully quantified in terms of land mobility and use, it is likely the overall economic shock coupled with less transactions for Q2 and Q3 which in turn could impact price for 2020.”