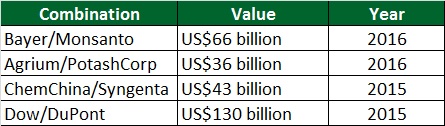

Over the past two years, four major mergers and acquisitions deals have been announced in the farm inputs sector, representing over US$200 billion of deal value, Kenneth Zuckerberg of Rabobank has said.

The Senior Analyst for Farm Inputs said that while each transaction is subject to a unique set of opportunities, challenges and uncertainties, the common thread is that input manufacturers must re-position themselves to compete in an environment of lower farmer margins and more efficient use of inputs.

“The uptick in merger and acquisition activity involving farm inputs providers is a direct response to challenging sector fundamentals and structural shifts.

“Specifically, the fall in commodity prices since the 2013 cycle peak, coupled with a strong US Dollar, has been compressing US row crop farmers – and consequently pressuring revenues and earnings for the major publicly-traded inputs providers.”

Rabobank sees bottom-line pressures continuing into 2017.

According to Zuckerberg, a common deal driver is the need for input companies to transform themselves in order to better compete in a low-growth, low-return environment.

While each deal has its own unique opportunities, challenges and uncertainties, Rabobank sees the recent M&A wave falling into five categories:

- Access to new markets, technologies and expertise (ChemChina/Syngenta).

- Food security and reduced reliance on imports (ChemChina/Syngenta).

- Value creation through scale and strengthened competitive positions (Bayer/Monsanto, Dow AgroScience/DuPont Pioneer).

- Market dominance in key product categories (Bayer/Monsanto, Dow AgroScience/DuPont Pioneer).

- Operational efficiencies through vertical and horizontal integration (Agrium/PotashCorp).

Rabobank believes that these recent deals will have differing implications across the value chain:

Growers

Farmers could actually benefit from industry consolidation in the form of new products and services.

In the short term, smaller farm input providers could create new innovative products, as the newly-merged entities are distracted integration activities. Longer-term, the merger companies will likely increase R&D spending in order to revamp legacy product portfolios and deliver greater value to farmers.

Fertiliser manufacturers

The fertiliser complex remains quite challenging due to pressure on farmer income, shifting farming practices in support of reduced mineral fertiliser usage, and global oversupplies.

Rabobank expects little incremental impact from the announced CPC/seed mergers, although the Agrium/PotashCorp situation could result in mergers among smaller players.

Input distributors

The announced mega-mergers will result in greater concentration of power among input manufacturers.

Thus retailers, wholesalers and cooperatives may experience margin pressure as manufacturers renegotiate selling commissions and concessions.

Grain and oilseed players

The ABCDs (ADM, Bunge, Cargill and Louis Dreyfus) have been – and continue to be – active in re-positioning their product portfolios, as farming enters a ‘new normal’ period of low growth and average returns.

The announced mega-mergers could impact G&O company strategies over the long term, but unlikely in the short term.

Consolidation is a logical and natural response to lower organic growth opportunities. The recent wave of farm input mega-mergers is a direct response to challenging industry fundamentals – namely an extended period of low, but stable commodity prices and average farmer returns, according to Rabobank.

Although the deals have different implications across the ag value chain, Rabobank believes that input distributors are the most exposed to near-term margin pressures.