Tesco has reclaimed the top spot as Ireland’s number one retailer, latest figures from Kantar Worldpanel show.

Supervalu had overtaken the retailer in previous months.

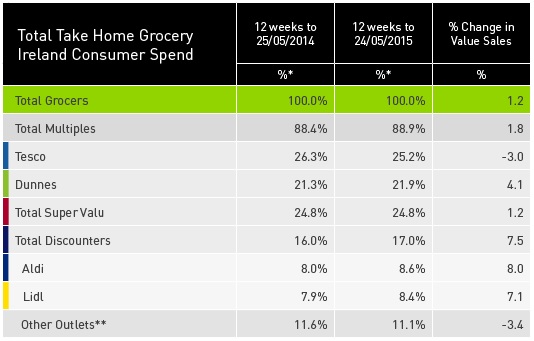

Figures for the 12 weeks ending May 24 show that across the overall market sales grew by 1.2% year on year.

Georgieann Harrington, Insight Director at Kantar Worldpanel, said that while Tesco now has 25.2% of the grocery market share, it is still seeing sales decline as their performance remains behind the market.

“However, Tesco’s value initiatives online and in-store have helped boost the number of visits to its stores by 1.4%. The retailer has also seen a spend increase of 0.5% from families with children,” she said.

She also said that Tesco still has some ground to recover to regain the 26.3% share of the market it had a year ago.

While the retailer held the top spot for just a short period, the battle for dominance will continue over the summer months, a traditionally strong season for Supervalu, it says.

Supervalu’s share of the market is consistent compared to a year ago and its sales also grew by 1.2%, Kantar says.

Supervalu is the only retailer among the big three to consistently win new shoppers and its initiatives such as ‘Good Food Karma’ have had a positive impact for the retailer and helped it attract over 12,000 new customers this period, it says.

Dunnes Stores posted the strongest sales growth among the big three retailers at 4.1% bringing its grocery share to 21.9%, Kantar says.

This is the Dunnes Stores sixth consecutive month of growth, despite some negative publicity in recent months, it says.

Elsewhere in the market, Aldi and Lidl grew sales by 8.% and 7.1% respectively and the two German discounters now hold a combined share of 17% of the market.

Both Aldi and Lidl have seen their growth slow over the past few months however, remain in a strong position given the overall market growth of 1.2%, it says.

Aldi continues to win shoppers with its ‘As Irish as’ campaign, with an impressive 43,000 additional shoppers this period, Kantar says.

Lidl also benefits from a shopper boost, with the average shopper increasing their spend by €8 over the period, in part down to its recent voucher activity, it says.

“With shoppers paying 0.6% more for their groceries compared to last year, competition is fierce between the retailers as they battle it out to offer best value for money,” Harrington says.