It seems milk prices have peaked. It’s not a dramatic fall off in price, but Global Dairy Trade (WMP) is back 25%. Dairy market predictions at the start of the year is that they would soften towards the end of the year, but it seems to be happening already.

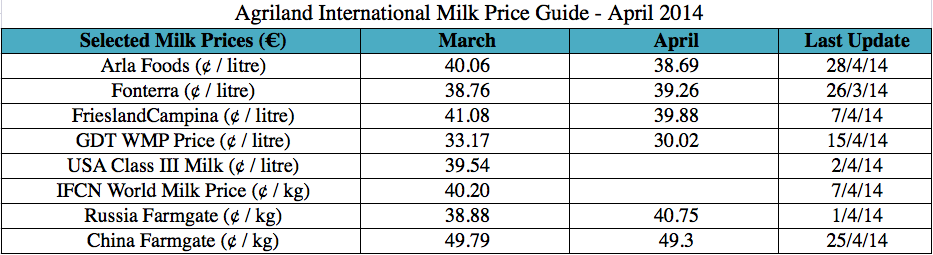

The milk price table for April, shows that a number of processors have dropped their price on March. Milk prices in New Zealand and China hit all time highs earlier this year. The Chinese price has now begun to soften. It will be interesting to see what Fonterra announces in a month’s time as its opening 2014/2015 season forecast milk price.

- Arla Foods – Arla announced price constituent drop in late April to €6.09 kg/Protein and €4.68 kg/Fat, resulting in a price drop of about 1.37c/L since March

- Fonterra – Forecast Cash Payout price unchanged since the end of February. Changes noted in the table reflect currency changes. It should be noted that New Zealand is now approaching the end of its milk season (May is equivalent to the Ireland’s December milk supply). Their new season will start in early June. Given the on-going price drops in Global Dairy Trade (GDT) auction prices, it will be interesting to see Fonterra’s opening forecast price for the 2014/2015 milk season. This price is usually announced at the end of May.

- FrieslandCampina – Farmgate milk price drops for the third month in a row to €6.9376kg Protein, €3.4688kg Fat, and €0.6938kg Lactose. Current prices are back about 4% per litre since January.

- GDT Whole Milk Powder (WMP) – WMP prices from thew April 15 auction are quoted at US$4,339 tonne. Prices from the corresponding auction in February were US$3,900 per tonne. GDT WMP auction prices have fallen 25% since the first auction in January 2014.

- USA Class III Milk Price – USA ‘announced’ Class Milk Prices for March for 3.5% Fat milk was $23.33 per 100lbs. When calculated for Irish milk constituents this shows a 0.6% or 0.25 ¢/L drop when compared to the February price.

- IFCN Global Raw Milk Price – The global IFCN milk price indicator for March is 2% lower than February’s price at $54.80 per 100kg of milk (January price $54.30 per 100kg)

- Russian Farmgate Milk Price – The Russian Farmgate milk price continues to rise. The early April price is quoted at 19.82 Roubles is up from the early January price of 18.15 Roubles. However, when presenting this price in Euros a weakening of the Russian currency negates much of the gain.

- China Raw Milk Price – Whereas China’s Farmgate milk price may seem very high, it should also be noted that their input costs are also high. Average milk prices at the end of April at 4.21 Yuan, down from the February high of 4.27 Yuan. Product prices remain strong, with Imported Infant Formula selling at around 204 Yuan per kg or €23.9 per kg, and Domestic Infant Formula at 160 Yuan or €18.7 per kg. Prices for domestic UHT milk products are close to 10.5 Yuan or €1.2 per kg. However, domestic production costs continue to have a negative impact on profitability for Chinese UHT milk processors.

- Arla Foods – Differences listed in published table may also factor in currency fluctuations. Prices above have been converted to euros and adjusted for Irish milk constituents of 3.9% Fat / 3.35% protein. Price displayed in cent per litre.

- Fonterra – Differences listed in published table may also factor in currency fluctuations. Prices above have been converted to euros and adjusted for Irish milk constituents of 3.9% Fat / 3.35% protein. Price displayed in cent per litre.

- FrieslandCampina – Prices are reflective of Irish milk constituents of 3.9% Fat / 3.35% protein. Price displayed in cent per litre.

- GDT Whole Milk Powder (WMP) – Differences listed in published table factor in currency fluctuations. Prices have been converted into a cent per litre on the basis there will be 7690 litres of Irish Milk used to produce one tonne of powder. As Fonterra use GDT to help calculate their Farmgate milk prices, we have used Fonterra’s processing and sales costs figures to help estimate corresponding Irish processing and sales costs of 8.6 cent per litre (to process WMP powder). This cent per litre prices does not include associated freight / shipping costs and customs duties and should serve as a guide estimate only. Price displayed in cent per litre.

- USA Class III Milk – Differences listed above may also factor in currency fluctuations. Prices above have been converted to Euros and adjusted for Irish milk constituents of 3.9% Fat. Price displayed in cent per litre.

- IFCN World Milk Prices – Differences listed in published table may also factor in currency fluctuations. Prices as stated on the IFCN website for milk with 3.3% Protein and 4.0% Butterfat. Consequently these prices are not converted to Irish Milk Constituent values and should serve as a guide only. Price displayed in cent per kilogram.

- Russian Farmgate Milk Price – Differences listed in published table may also factor in currency fluctuations. Prices as stated by the Russian Ministry for Agriculture & are not converted to Irish Milk Constituent values and should serve as a guide only. Price displayed in cent per kilogram.

- China Raw Milk Price – Differences listed in published table may also factor in currency fluctuations. Prices sourced from BSNABC website & are not converted to Irish Milk Constituent values and should serve as a guide only. Price displayed in cent per kilogram.