It’s over 12 months on since the beginning of last year’s beef ‘crisis’ and beef prices are back down around the €4/kg mark.

Yet, the meat processors have said that this price puts Irish beef prices at 110% of the EU average and that these prices are not sustainable.

At the same time, the number of dairy-type calves coming into the beef system is increasing, as the dairy herd jumped by 45,000 since 2013.

Agriland reported recently that new beef markets have yet to take significant quantities – with the US only accounting for 31t of Irish beef this year.

Meat Industry Ireland has warned that the number of current markets available to Ireland need to be expanded.

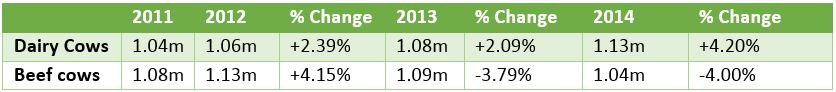

Increased Dairy Cow Numbers

Between 2013 and 2014 the national dairy herd increased by 4.2% or 45,200 head.

At the same time, this increase in dairy cow numbers lead to a corresponding fall in beef cow numbers, with a drop of 4% or 43,900 head over the same period.

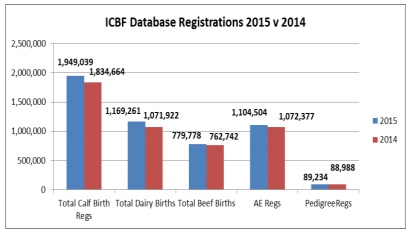

Increased calf births

On the back of increased cow numbers, calf registrations for the first five months of 2015 were up 6.6%, according to Bord Bia. An additional 110,000 calves were born during this period.

The largest increase occurred in the dairy sector with an additional 94,000 dairy-type calves on the ground, while suckler births up by 16,000, it says.

The 2015 increase in calf births is the second consecutive increase following a 4.4% slump in 2013.

Figures from the Central Statistics Office (CSO) indicate that calf births made a slight recovery by 2% in 2014, with the vast majority of these births having happened in the dairy sector, with births to dairy dams rising by 3.7%.

Irish Beef Exports

The beef industry accounted for 22% of Ireland’s agri-food exports in 2014, with a value of €2.27bn. There were 1.7m cattle slaughtered in Ireland in 2014, which was an increase of approximately 10% from 2013.

Currently, the majority of Irish beef exports end up in the EU. The UK is our largest export market, which accounts for 50% (270,000t) of the volume trade and is worth in the region of €1bn to the Irish economy. The majority of Irish beef product exported to the UK is for the foodservice sector (59%).

The remaining 41% is distributed through the retail sector, in the form of minced and diced products (60%) and steak and prime products (40%).

A further 238,000t is exported to the EU market, Department of Agriculture figures show.

Live Exports

Meanwhile, live exports have fallen by approximately 48,000 head this year. Live exports are critical for the Irish beef industry, says Bord Bia, as it presents an alternative price avenue.

The major falls have occurred in Belgium (-20,520), Italy (-10,254) and Spain (-14,788).

This fall in live exports along with increased calf births could potentially result in 150,000 additional cattle coming to slaughter in Ireland in the near future.

Market Outlook

Current Irish beef prices have been labelled as ‘unsustainable’ by Meat Industry Ireland (MII) the body representing Irish meat factories.

Irish finished cattle prices are presently at 110% of the EU average price, as continental markets for Irish beef remaining weak.

MII has also said that it is concerned about the weakening demand for beef products, especially across continental Europe, in part fuelled by the backlash from French importers.

French retailers and operators are now sourcing domestic product to appease the recent producer protests, this is forcing Irish exports to search for alternative market outlets.

MII also says the chances of any increased access to the UK retail sector have diminished due the recent “buy British” market sentiment there too.

The Russian embargo has also caused considerable international market disturbance, as EU exporters seek new markets.

Furthermore, as other commentators have noted, store cattle prices in Ireland are particularly unreflective of the current beef market trends, which have been cited for the reduced weaning and store exports.