Global Dairy Trade (GDT) had its latest auction today under the heading event 208, which resulted in a drop of 1.2% in the price index.

Lasting one hour and 55 minutes, today’s auction featured 14 bidding rounds with 125 winning bidders of the 513 registered. Some 18,635MT were sold at the event.

Lactose was not available on the day, while butter milk powder (BMP) was not offered.

- AMF index unchanged, average price US$6,249/MT;

- Butter index unchanged, average price US$5,281/MT;

- BMP not offered;

- Ched index down 3.9%, average price US$3,609/MT;

- LAC index not available, average price US$590/MT;

- RenCas index down 2.9%, average price US$4,948/MT;

- SMP index down 8.6%, average price US$1,887/MT;

- WMP index up 0.1%, average price US$3,226/MT.

Skimmed milk powder (SMP) recorded the most dramatic change on the day, dropping a substantial 8.6%. Cheddar also took a price hit, down 3.9%. Whole milk powder (WMP) was the only product to record a marginal increase on the day, up by 0.1%.

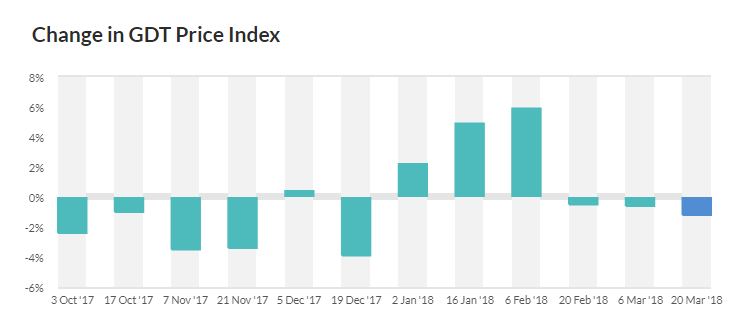

This is the third consecutive decrease recorded at GDT auctions, following on from three positive returns earlier in the year.

Milk price cuts and reaction

Meanwhile, several processors made the move last week to drop milk prices for February supplies. The move was heavily criticised by Gerald Quain of the Irish Creamery Milk Suppliers’ Association (ICMSA).

Quain described the announcements of price cuts early last week by Glanbia and Kerry as “a major blow to farmer confidence, as we head into the peak milk production months”.

It shows scant regard to the challenges facing farmers, like the still adverse weather conditions, fodder shortages, and increased input costs.

Continuing, the chairman said: “There’s a recurring pattern here that has processors imposing more and more standards and conditions on their farmer-suppliers on the basis that we can move up the value chain and achieve higher prices.”

Quain continued by noting that, in terms of price volatility, the farmer is consistently taking the hammering while still waiting for the long-promised and much-trumpeted transparency in the food supply chain – so that all links in the food supply chain can clearly identify exactly who benefits and gains from this volatility.